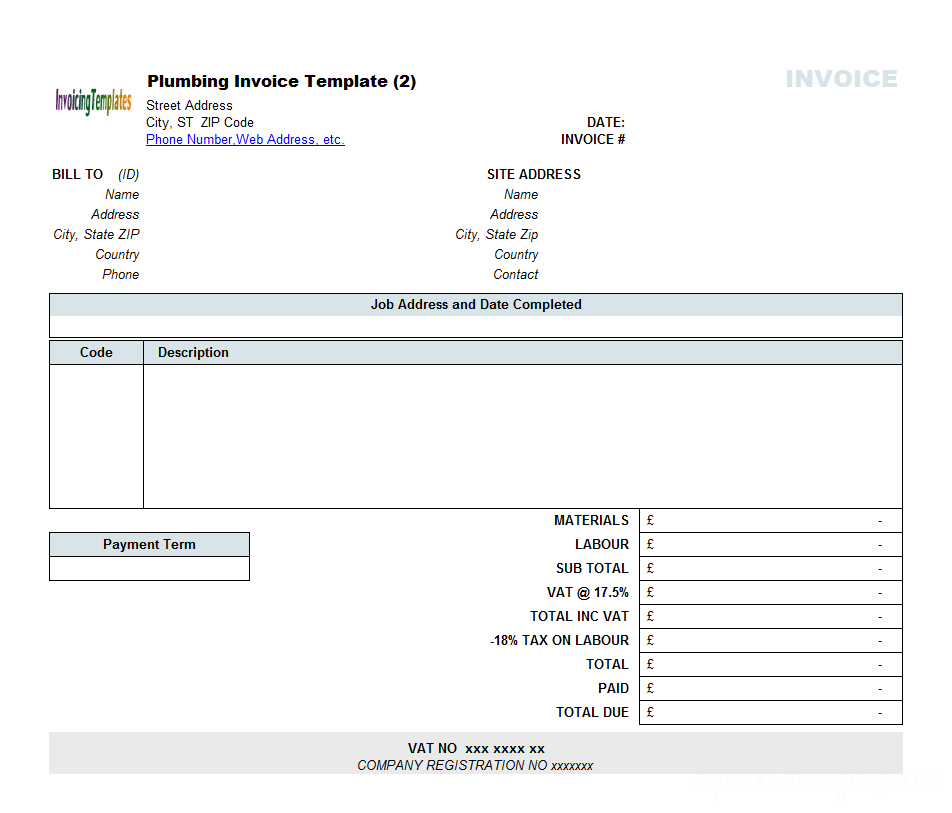

Yes, even if you don’t have a registered account, our invoice generator offers a customizable ready-made invoice template to create & instantly download the PDF copy of your Pakistan invoice or save the information to use later. How do I send a Pakistan VAT/No VAT invoice? Send the created PDF Pakistan invoice electronically or print it. The invoice should also have businesses’ name and logo on top and a few details along with. This invoice can also be used for any repairing purposes. If the product needed some repairs, the details must be mentioned on the invoice including any labor costs etc. Jewelry Invoice Template. For: EXCEL(.xls) 2003 & later Android+iOS & iPad.

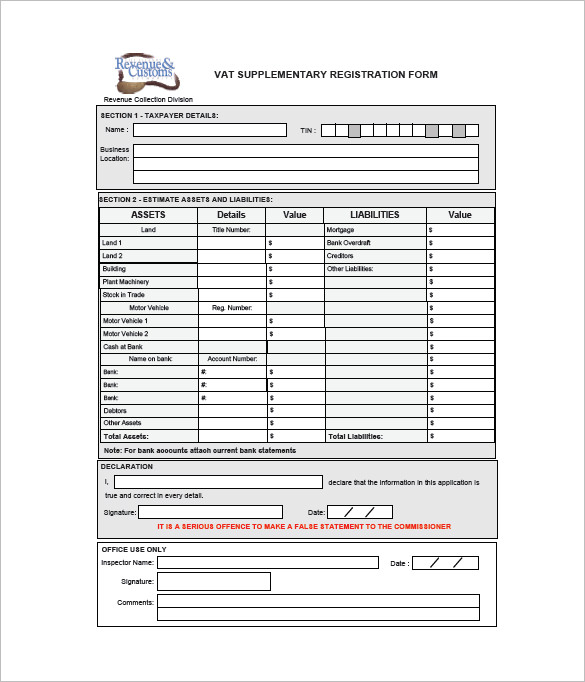

Who Should Register for VAT/Sales Tax in Pakistan

All businesses and suppliers of taxable goods must register for Pakistani sales tax via FBR’s online portal. Generally, tax registration will also require an in-person meeting. In order to process the application, you will be asked to provide the following:

● Business name

● Business address

● Business bank accounts

● Tax identification business directors

● Passports of business directors

Any Pakistani business that fails to register for sales tax may be fined. Since there is no threshold for businesses required to register for sales tax, most businesses will have to register with BIR. Although the registration threshold is nil, businesses with low business turnover may be eligible for a simplified sales tax scheme. Sales tax is due in Pakistan at the time of supply or at the time of payment.

Businesses registering with FBR for sales tax will receive a Sales Tax Registration Number (STRN) or User ID and password that will be used in all electronic filing for sales tax returns. Unlike many countries, non-resident businesses operating in Pakistan may not register for sales tax, regardless of turnover.

Jewelry is the best ornament to make a woman happy and beautiful. Most of the women like collecting different pieces of jewelry from time to time. Not only women buy jewelry on their own, most of the time they get presents which add meaning to the value of these things.

Tally Vat Invoice Format In Excel

With the passion of jewelry around the world, the business of jewelry making has also been very popular in every country. With every business, bookkeeping and managing the transactions also becomes a big challenge. Making jewelry is a very keen task as it involves the materials such as gold and silver and other gems like pearls and diamonds which make it a tough job.

Jewelry- an ornament that adds in the beauty of women, no matter it is a necklace, a ring or a small bracelet; it is loved and fancied by a woman of all ages. Because of this love of women for this jewelry, the business of selling it is flourishing everywhere in the world. With a flourishing business comes the great responsibility of keeping a record. To keep this responsibility satisfied, jewelry invoice came on the surface. This invoice keeps a full record of all the transactions made on a particular day and helps the jeweler and his business moreover, it also makes easier for the purchaser to see all the details and raise an eyebrow on what seems to be out of the question to him. This shows that the invoice can prove itself to be very useful for both the parties.

Vat Invoice Format In Excel Template

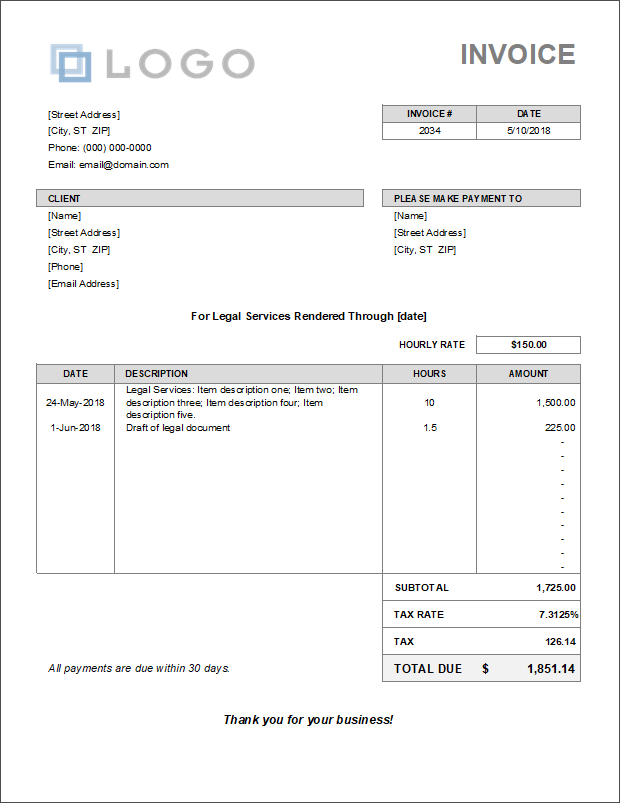

Some of the details that this invoice will need are as follows:

- Date and invoice number

- Rate of gold on that particular day or whatever the jewelry type is

- Name or type of product

- Cost and other descriptions regarding the product

- Weight of the product purchased

- Amount calculated

- Details of sales person

- Name or details of customer (not necessary)

- Guarantee, warranty or insurance provided etc.

Invoice makes it more transparent for the customer and the seller to keep a track of all the materials used and the effort added to make that. The invoice has a lot of benefits for the buyer and the seller as well. The invoice is a proof of purchase and if anything goes wrong with the jewelry, the buyer can always bring it back and get it fixed.

The most important information for an invoice is the price of gold/silver on that very day. This makes it easy to calculate the cost of the jewelry item. The labor costs and the making of the item will also add in the invoice along with the detailed description of the item.

The weight of any jewel means a lot and has to be included in the invoice. The details of the sales person will be mentioned on the invoice. The sales person is the most knowledge person for that item and can be contacted in case of any confusion.

The invoice should also have businesses’ name and logo on top and a few details along with. This invoice can also be used for any repairing purposes. If the product needed some repairs, the details must be mentioned on the invoice including any labor costs etc.

Preview

Jewelry Invoice Template

For: EXCEL(.xls) 2003 & later [Android+iOS] & iPad

DownloadFile Size: 35 kb

For: OpenOffice Calc [.ods]

Download File Size: 20 kb

Vat Invoice Format In Uae Excel

[Personal Use Only]